Review of The Reckoning, in the light of the AI boom

The AI boom’s profits rest on old instincts: to stretch time, hide cost, and believe the ledger before the reality beneath it.

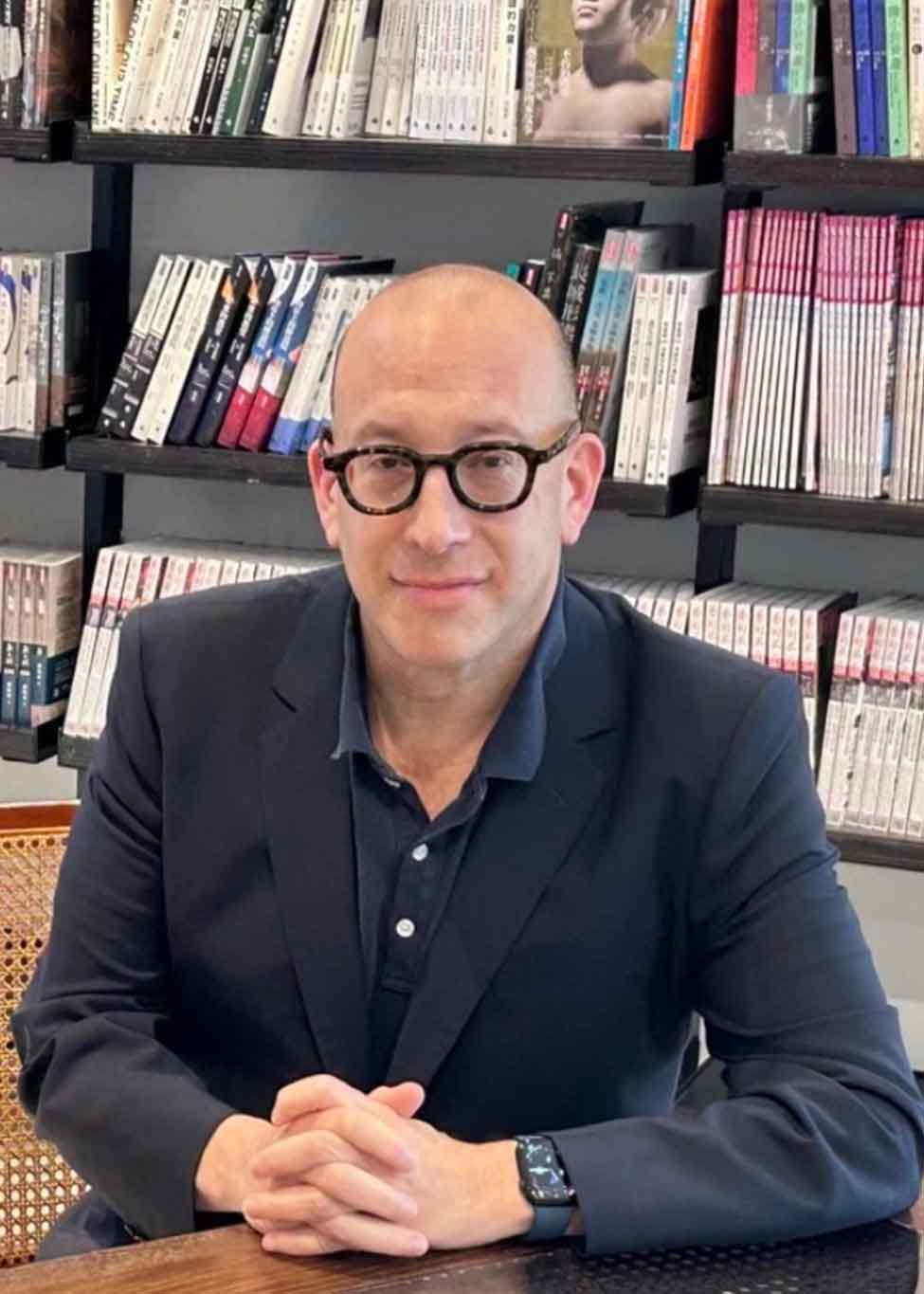

The Reckoning by Jacob Soll traces how accounting shaped states, markets and the very idea of value. It shows how ledgers do not simply record reality. They help create it. I read the book some time ago, but came back to it now because we are in the middle of a new accounting challenge.

The AI boom depends on investment and on the stories that justify that investment. This piece is a review of Soll’s book, with examples from today’s digital economy.

Key points

- Accounting choices decide what counts as value

- Capital investment in AI relies on optimistic assumptions about time

- Depreciation schedules for GPUs shape expectations of growth and profit

- Numbers often smooth over uncertainty and risk

- The past suggests that reality eventually forces a reckoning

From ledgers to data centres

Soll follows a long tradition of people trying to master the future by writing it down. Double entry bookkeeping allowed merchants and states to stretch time, to commit to future income before it arrived, and to hide fragility behind precision. It created accountability, but also imagination. Growth often needed belief first and proof later.

Modern cloud infrastructure feels similar. Hyperscalers and AI companies invest billions into data centres, chips and power. These assets are justified on the basis of a horizon: three years of useful life for a GPU, or perhaps six. The difference between those two assumptions can turn a narrow margin into a headline success story. When model updates accelerate and hardware cycles shorten, the ledger is forced to catch up with physics.

“I didn’t want to get stuck for four years, five years of depreciation on one generation…” — Satya Nadella, Microsoft

Accountants decide how quickly servers and GPUs lose value on the books. Investors then take those numbers as signals. But the reality beneath the figures may move differently. A chip that is technically fresh can already be strategically old if the next generation trains models at half the cost. In the AI economy, value decays along performance curves, not in tidy annual increments.

Soll’s history is full of moments where growth masked fragility. Narratives filled the gap between ambition and evidence. When confidence broke, books were corrected, sometimes brutally. The question today is not only whether companies mislead. It is how long optimism can overshadow the material constraints of energy, location, supply chains and latency.

What we choose to see

A ledger is a lens. It highlights some aspects and fades others. If cost is pushed into the future, present gains look larger than they are. If complexity is simplified, risk becomes hidden. In AI, where the cost of progress is both upfront and ongoing, it is tempting to treat almost everything as long lived capital and relatively little as immediate expense.

We are still learning how to record assets that learn and decay at the same time. Training improves value. Rapid technical change, however, accelerates obsolescence. Traditional bookkeeping is not fully equipped for this tension. The choice of a three year or a six year horizon for hardware life is not just a technical footnote. It encodes a view of how fast the world will move.

Soll never presents accounting as pure deception. He shows that accounting is a judgement. Someone decides what future to believe in, and how much uncertainty to expose on the page.

The book itself

As a book, The Reckoning is broad in scope. Soll moves from Renaissance merchants to emerging nation states and modern corporations, showing how shifts in bookkeeping enabled expansion but also created new fragilities. For readers in digital infrastructure, finance or technology, it sharpens the sense that numbers are always choices and that those choices carry political intent.

Closing reflection

This book helped me see the present moment more clearly. For anyone working with AI strategy, energy heavy compute or digital infrastructure, The Reckoning offers a historical grounding that feels necessary. It reminds us that every boom is fuelled by expectations and that eventually the books must match the world. I find it highly relevant and very much worth reading.