How Money Moves

A new payment feature raised a bigger question: how does money actually move today? From wallets and card networks to regulation, this is a map of a system most of us never see.

A reconnaissance of wallets, cards, networks, and digital payment rails

I did not set out to write about money. I noticed a feature.

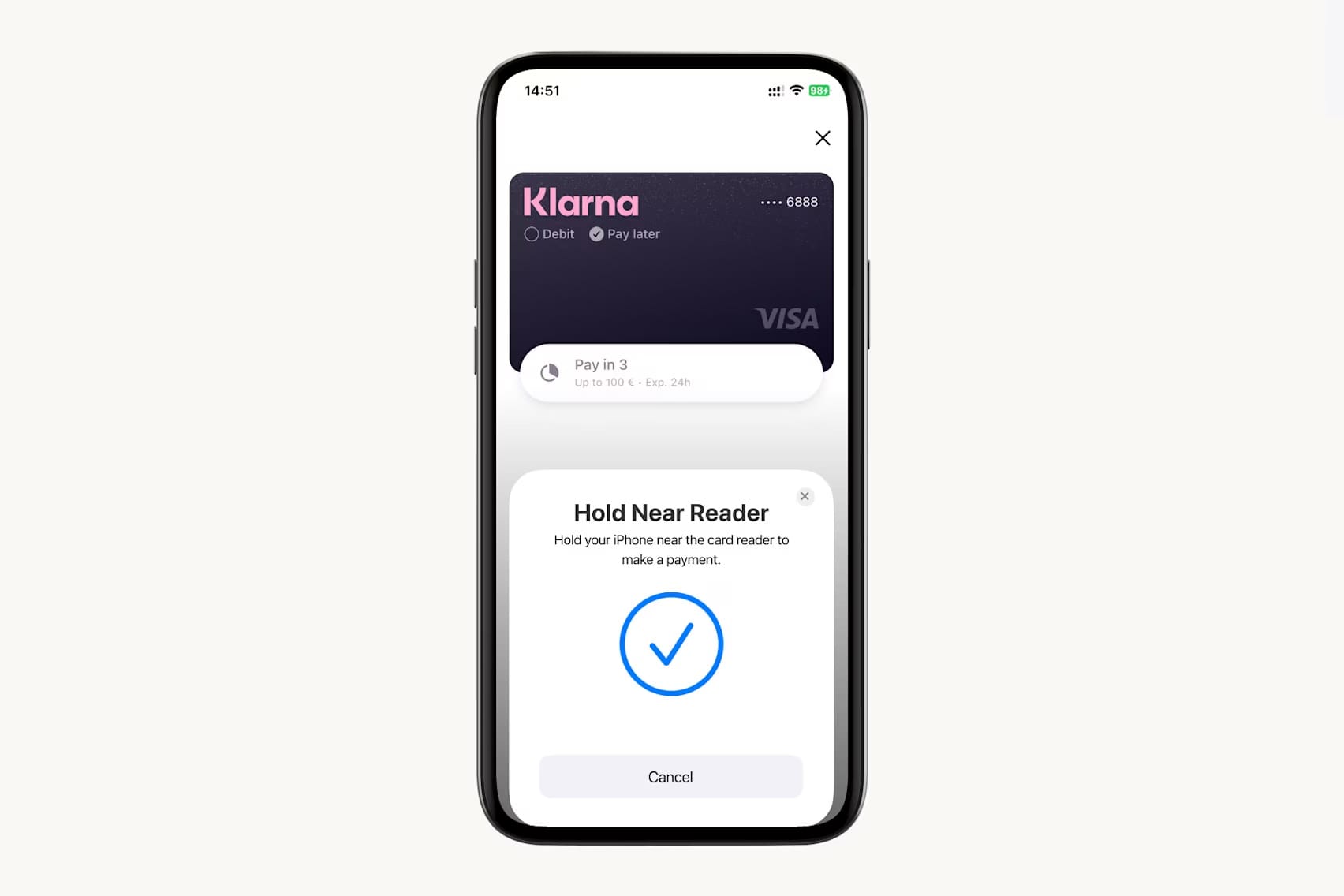

Klarna appeared in the news with something new: tap-to-pay in physical shops, including on iPhone. That small announcement was enough to unsettle a comfortable assumption. I use my phone to pay. I thought I knew how that worked.

I did not.

This piece is an attempt to look around rather than draw conclusions. A reconnaissance of how money now moves through digital systems, and why a change that looks minor at the surface may signal a deeper transition underneath.

The disappearing card

For most people, the payment card has already vanished as an object. We no longer reach for plastic. We tap a phone or a watch.

Yet the system beneath remains card-based. What changed is the interface. A physical card is replaced by a token stored on a device, authenticated by biometrics, transmitted via NFC. The card fades from view, but the card network persists.

This distinction matters because when payments appear to change, they often only shift shape rather than substance.

Wallets as interfaces, not money

A digital wallet is not money and not a bank. It is an interface.

Apple Pay, Google Pay, Klarna, and various bank wallets are containers for credentials. They determine how payment is initiated, how it feels, and which rails are used underneath. Those rails may be global card networks, bank-to-bank transfers, or lines of credit.

Crucially, some wallets are not just software interfaces but hardware-level integrations. Apple Pay is tied to a physical gesture, biometric sensors, and lock-screen access. That coupling collapses payment into a reflex. Other wallets, even when technically capable, must operate at the application layer. That difference alone shapes habit, adoption, and power in the payment landscape.

Seen this way, Klarna’s move into physical shops becomes clearer. It did not invent a new payment method. It extended its interface into a space that had long been dominated by device-level wallets.

The networks beneath the surface

Although users rarely notice them, global card networks sit at the centre of most retail payments. Visa and Mastercard handle routing, acceptance rules, tokenisation, fraud management, and dispute resolution at planetary scale.

Banks issue cards and manage customer relationships, but they depend on Visa and Mastercard for interoperability and reach. Without these networks, most everyday payments would stop working outside narrow domestic contexts.

Their influence is powerful precisely because it is not experienced directly.

Europe’s counter-current

Initiatives such as Wero arise from a different ambition. They do not primarily compete by refining interfaces. They attempt to rebuild the rails.

Wero is designed around bank-to-bank transfers using SEPA Instant. Its aim is to reduce reliance on card networks such as Visa and Mastercard altogether. The trade-off is explicit. Infrastructure control is prioritised over frictionless experience.

This difference shows in use. Account-to-account payments tend to require visible action. The user initiates, confirms, and authorises. Paying does not disappear into the device.

Regulation as a point of revelation

The Digital Markets Act forced Apple to open NFC access within the European Union. No new technology was introduced. An exclusive constraint was removed.

Once that constraint disappeared, wallets that already existed could surface at the point of sale. Klarna’s tap-to-pay feature is one of the first visible outcomes. Others will follow.

Here, regulation does not dictate outcomes. It reveals structure. It brings into view the layers that had shaped behaviour quietly for years.

A transition, not a replacement

What is unfolding is not a clean handover from one system to another.

Cards persist beneath wallets. Wallets multiply above Visa and Mastercard. Banks, platforms, and regulators apply pressure from different directions. Power shifts slowly and sideways.

Some models optimise speed and invisibility. Others prioritise control and resilience. None fully replaces the rest.

Why this is worth mapping

For those who are digitally fluent, payments feel solved. For others, they feel opaque. In both cases, the underlying structure remains largely unseen.

A simple tap connects hardware, wallet software, banks, global networks, and public policy. Mapping how money moves is not about prediction or prescription. It is about noticing how everyday gestures travel through layered systems shaped by technology, corporate incentives, and regulation.

This is reconnaissance. The surface keeps shifting. The rails underneath are where the real negotiations continue.