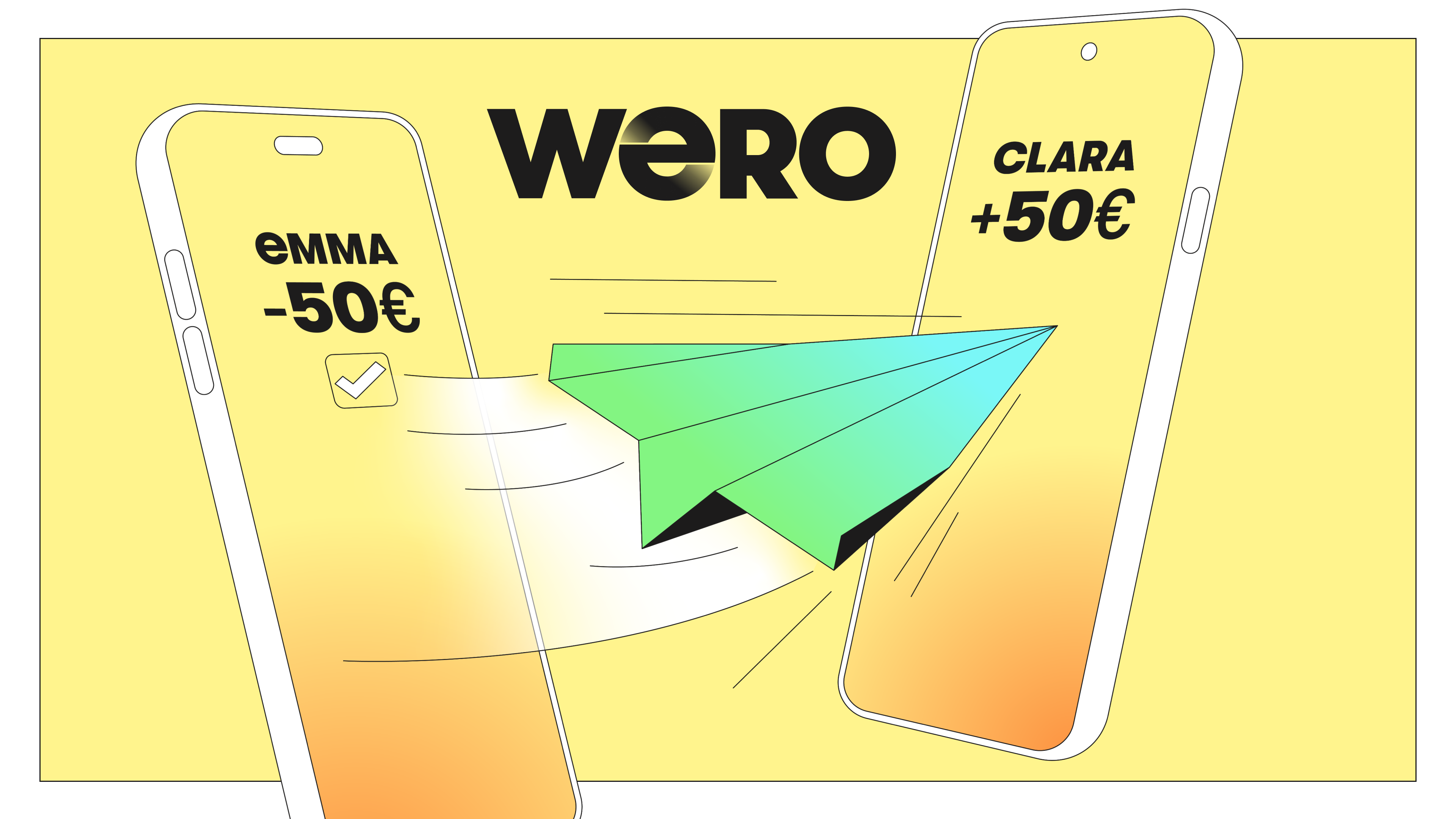

Wero: Europe’s new payment brand

Wero is Europe’s bid for payment sovereignty: pay across borders with just an email or phone number, without relying on US networks.

Europe is introducing a unified way to pay: Wero. Backed by the European Payments Initiative (EPI), it aims to become the common standard for instant bank-to-bank payments across the continent.

What it is

Wero is not a wallet like PayPal. It doesn’t hold money itself. Instead, it works more like a train service running on tracks that already exist. The tracks are the European instant transfer system (SEPA Instant). Wero is the branded service that lets people actually ride those tracks: by pressing “pay with Wero” in a shop or app.

What Wero adds is the user-friendly part: instead of typing in long account numbers (IBANs), you can use a phone number, email address, or scan a QR code. This is about addressability, reaching people through identifiers they already use and remember.

Wero. Not sure why they call it a wallet, it does not contain money.

Why it matters

Europe today is fragmented. The Dutch use iDEAL, Belgians Payconiq, Swedes Swish, Spaniards Bizum. Each works fine at home but stops at the border. At the same time, much of Europe relies on American systems such as Visa, Mastercard, and PayPal.

For merchants, those card-based systems are often costly. Wero, by moving money directly from bank to bank, promises lower fees, faster settlement, and fewer intermediaries.

Wero is meant to connect these islands into one European brand, reducing dependence on outside players while making payments more efficient for businesses and consumers alike.

Where it stands

In 2025, Wero is only just starting. It has launched in France, Germany and Belgium, but adoption is still small.

In the Netherlands, iDEAL continues for now, with migration planned for later. For most Europeans, Wero is still something you read about rather than use.

Looking ahead

Wero is less about today’s convenience and more about tomorrow’s sovereignty. If it works, it could become Europe’s answer to Venmo in the US or UPI in India: a shared, simple, cross-border way to pay, built on tracks Europe already owns.