Direct Debit: US versus EU

A viral US video warns against debit cards. The real difference, however, lies in how direct debit works in America versus Europe, and why that matters.

A video has been circulating on social media in which an American banker gives very firm advice: never use a debit card if you can avoid it. Use credit cards for everything. Debit cards, he argues, expose your bank account. Credit cards protect you by putting distance between merchants and your money.

The advice is confident, widely shared, and in a US context, largely reasonable.

This is why you should Never use a Debit card ‼️ pic.twitter.com/PfwtEvoSAO

— Manly Mentor (@manly_mentor) December 28, 2025

From a European perspective, it also feels oddly off. Not wrong exactly, but mismatched. To understand why, you have to look past the cards themselves and focus on something else entirely: direct debit.

Cards are not the problem

Much of the discussion around the video focuses on debit cards versus credit cards. That is understandable, but it misses the real fault line.

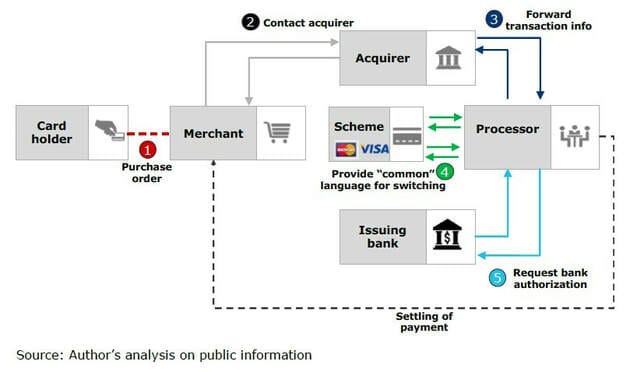

Card payments, whether debit or credit, work in broadly similar ways across regions. You initiate the payment. The merchant’s bank talks to your bank via a card network such as Mastercard, Visa, or Amex. Your bank checks whether the payment is allowed, based on balance or credit line, and settlement follows later. The card networks impose rules, including dispute and chargeback mechanisms.

There are differences in detail, but structurally this is familiar territory on both sides of the Atlantic.

The real difference sits elsewhere.

Direct debit is a different rail entirely

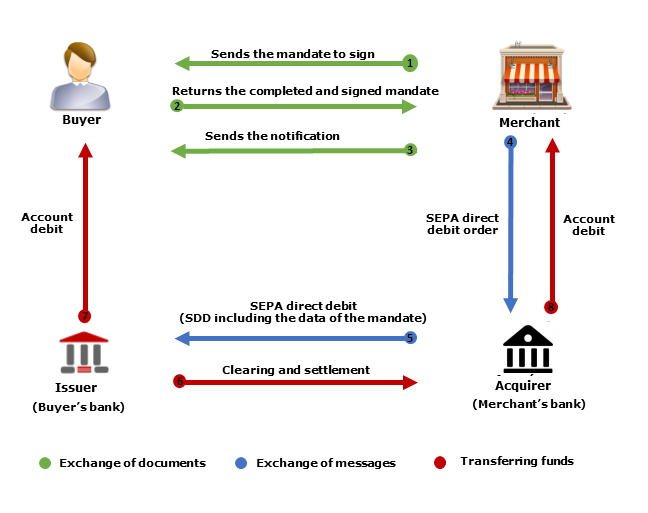

Direct debit works the other way around. Here, the merchant initiates the payment, based on permission you have previously given. This is not a card payment at all. It is designed for recurring charges: subscriptions, utilities, rent, memberships.

In the Netherlands, this is incasso. Across Europe, it runs via SEPA Direct Debit.

In the United States, it runs via ACH.

On paper, these systems look similar. In practice, they behave very differently when something goes wrong.

ACH versus SEPA: same idea, different assumptions

ACH is an old, pull-based system. Once a merchant has your bank details, payments can be initiated with relatively weak ongoing checks. Disputes exist, but they are slow, procedural, and often stressful. Money can leave your account first and only later become a subject of investigation.

This is the experience the American banker is speaking from. In that world, allowing direct access to your bank account is genuinely risky. Using credit cards instead is not a lifestyle choice, but a defensive strategy.

SEPA Direct Debit, by contrast, is built on a different set of assumptions.

In Europe:

- Direct debit requires an explicit mandate

- Mandates can be revoked easily

- Unauthorised debits can be reversed predictably

- Specific merchants can be blocked directly in a banking app

The system assumes that mistakes, abuse, and misunderstandings will happen and treats reversibility as a feature, not an exception.

This difference in default protections changes everything.

Why American advice sounds extreme in Europe

When Americans say “never use debit”, they are often talking about direct debit exposure, even if they describe it in terms of cards.

When Europeans hear the same advice, it sounds disproportionate, because direct debit here does not behave like that. The underlying system is simply more forgiving.

This is why advice that feels like common sense in one place can sound like fear-mongering in another. The disagreement is not really about financial literacy. It is about infrastructure.

The cultural layer on top

There is also a cultural difference that reinforces the gap.

In much of Europe, credit cards are still associated with borrowing money you do not yet have. Even people who use them tend to settle payments immediately or within days. Interest is avoided. Building a credit profile is not a goal.

In the US, credit cards have become a core consumer protection mechanism layered on top of weaker direct debit infrastructure. Rewards, chargebacks, and credit history are part of the same system.

The same tool exists in both places, but it plays a different role.

Travel is the exception, not the rule

There is one area where the American advice translates almost perfectly: travel, especially outside the EU.

Car rentals, hotels, deposits, and unfamiliar legal environments introduce distance and risk. In those situations, limiting direct access to your funds makes sense. Credit cards provide a buffer that debit and direct debit cannot.

Here, the logic is universal.

What this is really about

This is not a story about which card to use.

It is about understanding how close a payment method is allowed to get to your bank account, and what happens when something goes wrong. Systems encode assumptions about trust, error, and recovery. Those assumptions differ by region, and advice only makes sense inside the system it was designed for.

Once you see that, the viral video stops being provocative and starts being contextual.

Not wrong. Just local.